U.S. Fintech Trends: The Growing Digitization of Our Financial Lives | GlobalWebIndex

E-Commerce & Retail |

The Explosion of Digital Finance:

We can see that fintech is a fast-growing industry and it serves both businesses and consumers in different ways. Moreover, it is expected by experts that the industry will exceed $300 billion globally by the end of 2022.

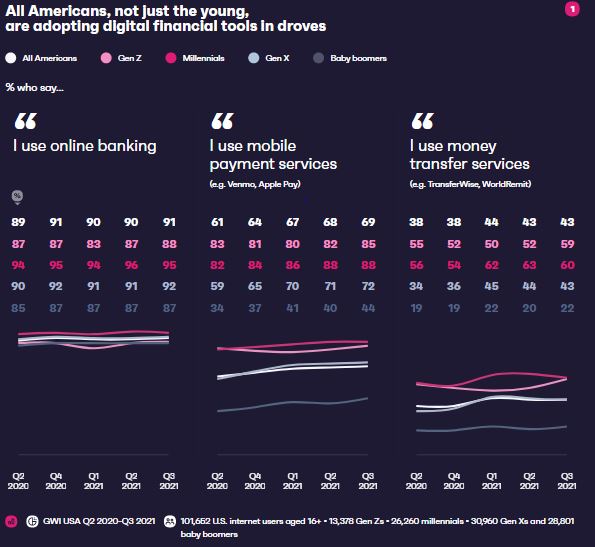

Here’s a chart of the fintech trends report that shows how Americans, not only the young, are adopting digital financial tools in droves:

When it comes to brand-new technology, older generations are usually much slower to adjust to a digital way of doing things.

In the case of online banking, however, it appears that growth has been remarkable even across the board.

- As we can see, by the beginning of 2016, two-thirds of US baby boomers were using internet banking services.

- However, that graph is now much closer to the national average of more than 90%.

- Furthermore, as many aspects of American life digitized instantly during the COVID-19 pandemic, the last few years have only accelerated the pace of digital finance overall.

- The COVID-19 pandemic made an ideal environment for mobile payment as well as money transfer services to thrive, and consumers took advantage of the chance to shop and pay each other remotely.

- Also, baby boomers were super excited, and they began using digital payment services at a much faster rate than younger generations, who were already familiar with these apps.

Related Article: B2B Marketing Guide for 2020: Which Industries to Target

The Mobile Wallet:

According to the fintech trends report, the great majority of smartphone owners in the United States consider it their most important device. Even after most of America’s out-of-home activities ceased in early 2020, consumers with larger screens turned to their phones for entertainment as well as, most importantly, shopping.

This isn’t a big discovery, given that a smartphone is required to navigate so many aspects of life nowadays.

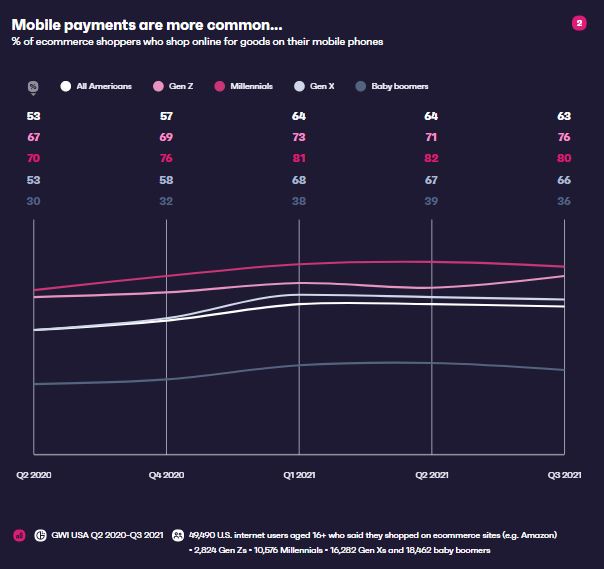

The following chart is from the fintech trends report and it shows the percentage of e-commerce shoppers who shop online for goods on their mobile phones in the US:

- According to the fintech trends report, 53% of all Americans in Q2 2020 shopped through their mobile phones.

- Also, in Q4 2020 a percentage of 69% of Gen Z used their mobile phones for online shopping.

- Moreover, 81% of Millennials in Q1 2021 used their mobile phones to shop online for goods.

- As well as 67% of Gen X in Q2 2021 use their mobile phones to shop online for goods.

- Additionally, 36% of baby boomers also shop online for goods on their mobile phones.

For more insights, you can check the full fintech trends report here.

The Table of Contents of “U.S. Fintech Trends: The Growing Digitization of Our Financial Lives Report”:

- Introduction

- Discover our data

- Key insights

- The explosion of digital finance

- The mobile wallet

- The buy now, pay later boom

- Financial attitudes across the generations

- Digital finance is good for business

- The retail investing boom

- Appendix

- Notes on methodology

Number of Pages:

- 23 Pages

Pricing:

- Free

Methodology:

All figures in this report are drawn from GWI USA, GWI’s online research among internet users aged 16+ in the U.S. Because we conduct our research online, we represent the internet-using part of the U.S. population only. According to our own projections, 90% of the U.S. population aged 16+ are internet users.

GWI USA has been designed so that all questions are mobile-friendly. Respondents are therefore able to complete the survey via mobile, tablet, PC/desktop, or laptop/notebook. This means respondents take the same version of GWI USA regardless of the device they are using