Digital Marketing Practices Q2, 2019 Report | Merkle

Digital Marketing | Global

Organic search is more cost-effective in the long run. However, the right tweaking and optimization of your campaigns, keywords and landing pages, paid search can become very cost-effective as well.

With an effective search strategy, your brand can dominate both paid and organic search results, resulting in increased targeted traffic for your search marketing efforts while giving an impression that you are an established company in your market.

Google had served its shopping ads on Yahoo since early 2016, and while the Yahoo volume was small compared to the shopping traffic Google produces on its own properties, losing it depressed Google’s shopping and overall search ad growth rates. On the flip side, Microsoft’s Bing product Ad format, which picked up the Yahoo inventory, delivered its strongest desktop spending growth in over three years.

The Key Findings of “Digital Marketing Practices Q2, 2019” Report:

- Total advertiser investment in paid search grew 14% Y/Y in the US market in Q2 2019, a slight deceleration compared to the previous quarter.

- Desktop Google shopping ads produced a 12% higher average revenue per click than comparable non-brand text ads in Q2 2019.

- Among brands participating in Google’s local inventory ads (LIAs) program, LIAs produced 23% of all the Google shopping ad clicks in Q2 2019.

- Google partners produced just under 4% of Google Shopping ad clicks at the end of Q2 2019.

- Google search ad click share for RLSAs hit a nearly two-year low in Q2 2019, accounting for a little over 17% of all clicks.

- The “Get Location Details” clicks, as they are reported by Google, generated about 8% of phone text ad clicks in Q2 2019.

- Retail and consumer goods brands saw the largest click growth rate of 10% Y/Y, while their CPC increases were a more modest 5%.

- Phones produced 69% of retail and consumer goods clicks, compared to just 39% for insurance where mobile CPCs are far closer to parity with desktop.

- Across search ad platforms, phone CPCs for non-brand ads were 53% lower than desktop CPCs in Q2 2019.

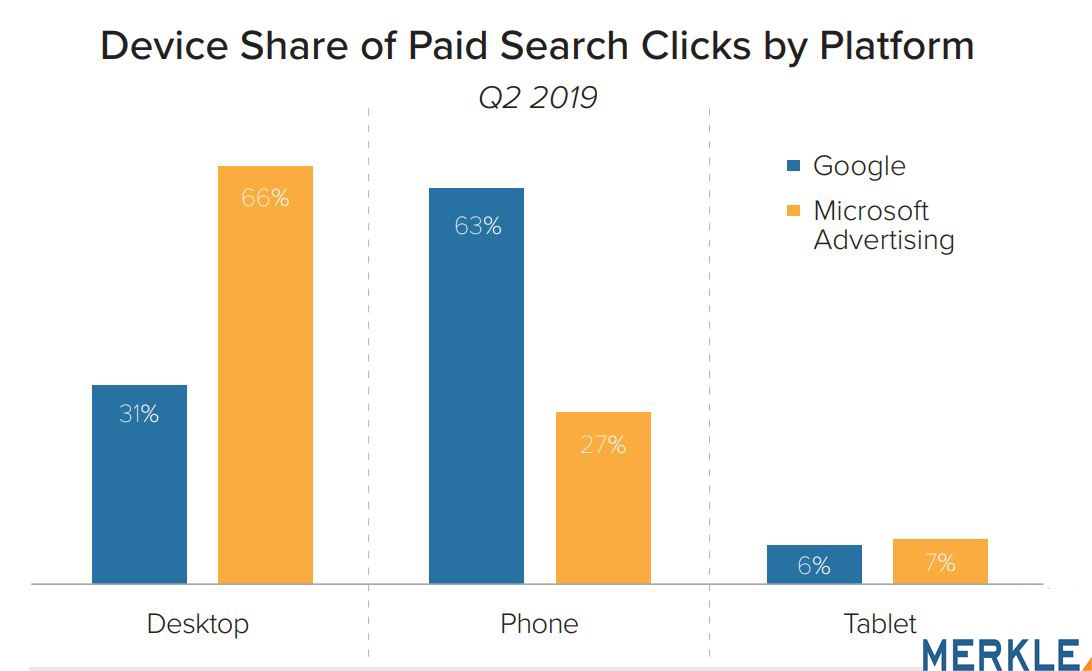

- Google generated just under 63% of its search ad clicks on phones, up to about half a point from a quarter earlier in Q2 2019,

- Desktop accounted for just 31% of Google clicks.

- Google accounted for 93% of organic search visits to brand sites in Q2 2019.

- Phones accounted for 51% of organic search visits in Q2 2019.

- Social media sites produced just over 4% of visits to brand sites in Q2 2019.

A Graph Shows The Device Share of Paid Search Clicks by Platform in Q2, 2019.

The Content of “Digital Marketing Practices Q2, 2019” Report:

- Executive Summary.

- Paid Search.

- Organic Search and Social.

- Display and Paid Social.

- Amazon Ads.

Number of Pages:

- 28.

Pricing:

- Free.

Methodology:

Figures are derived from samples of Merkle clients who have worked with Merkle for each marketing channel. Where applicable, these samples are restricted to those clients who have maintained active programs with Merkle for at least 19 months, have not significantly changed their strategic objectives or product offerings, and meet a minimum ad-spend threshold. All trended figures presented in this report represent same-site changes over the given time period unless otherwise specified, the data points in this report are derived from the North American market region.

Merkle

- Tesco PLC

- Aviva

- NOW tv