Grocery eCommerce Sales Is Expected to Rise 23.4% to $32.22 Billion in 2020 | eMarketer

E-Commerce & Retail | USA

We all have seen the impact of COVID-19 on almost every industry; it also has an impact on the US economy, as it can be hard to imagine retail going back to normal one day.

Putting aside the many brick and mortar retailers watching foot traffic and sales drop to almost zero, the most extreme shift in consumer behavior is currently happening in grocery eCommerce, possibly, this shift will have one of the longest consequences.

Keep on reading to figure out the online grocery shopping statistics in the US.

Retail eCommerce Sales Share in the US—General Focus

Talking about Spending, it was mostly consonant in the first three quarters of the year, however, afterward, it saw an expected surge in Q4. But coming out of Q4, eCommerce spending patterns never dropped back to where they were before. Alternatively, they locked in most of the Q4 gains and set a higher, and new baseline for the coming year.

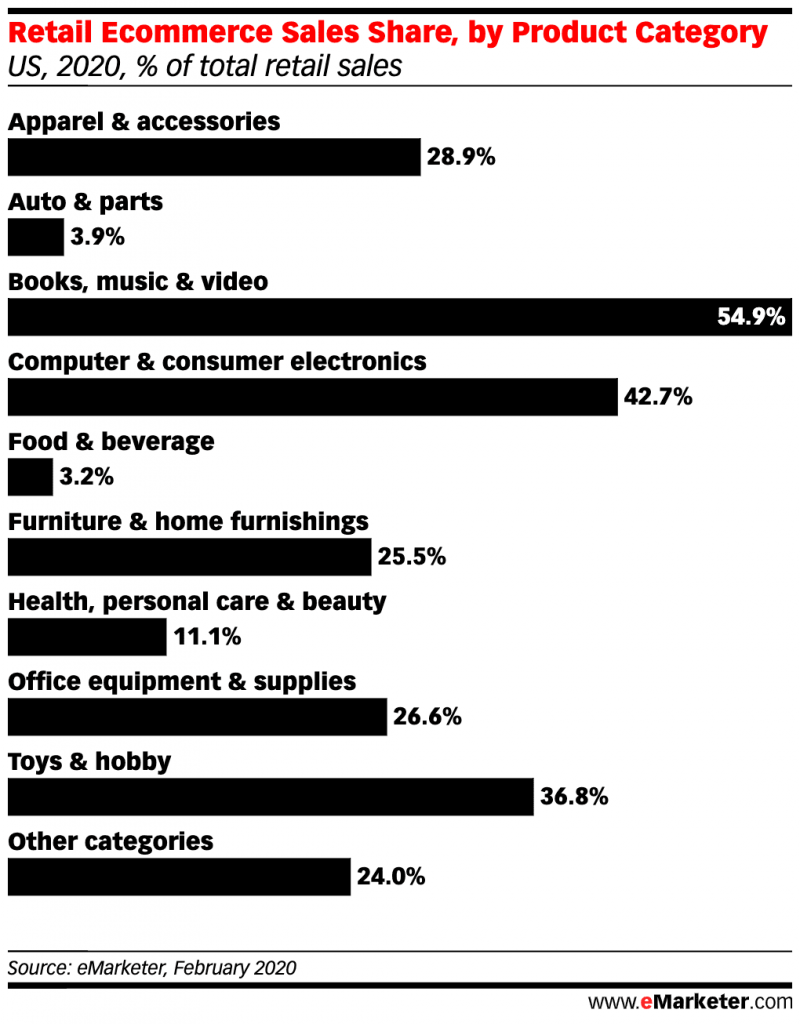

Based on the eMarketer recent eCommerce forecast, which is earlier to coronavirus, it was expected that US food and beverage eCommerce sales to grow 23.4% to $32.22 billion this year, along with the segment accounting for just 3.2% of complete retail sales.

A Figure Shows the Retail eCommerce Sales Share by Product Category of Total Retail Sales—2020 Data

As shown in the chart, the top 5 sales share in the US by product category are:

- Books, music, and video, and the percentage is 54.9%.

- Computer and consumer electronics, and their percentage are 42.7%.

- Toys and hobby and their percentage are 36.8%.

- Apparel and accessories, and their percentage are 28.9%.

- Office equipment and supplies, and their percentage are 26.6%.

Grocery eCommerce Insights 2020— A Focus on the USA

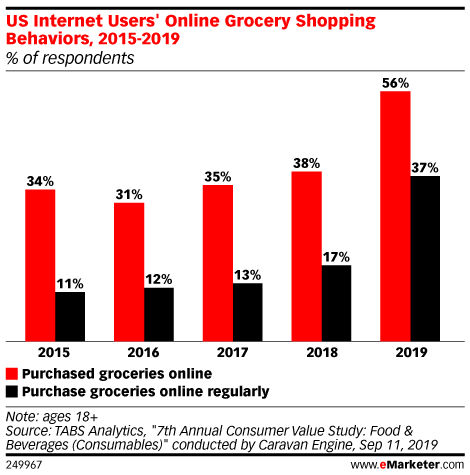

The chart below shows the US internet users’ grocery shopping behaviors

A Figure Shows the US Internet Users Online Grocery Shopping Behaviors 2015-2019

- As the chart shows, the purchased groceries online’s percentage has been increasing over the years.

- Since 2015, it was 34%, however, back in 2016, it has decreased to 31%.

- On the other hand, it grew to 35% back in 2017 and continued to increase in 2018 with 38%.

- In 2019, it has increased to 56%.

Related Report: Groceries 2.0 Revisited: The Rise of Online Grocery Shopping, 2018

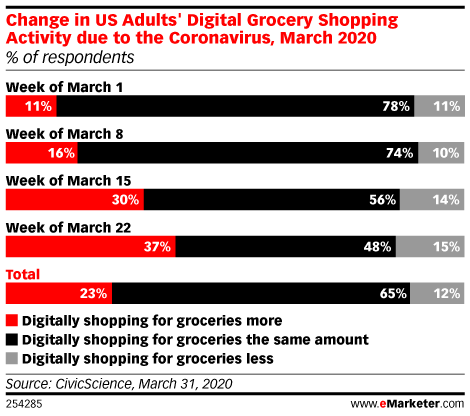

NetElixir reported that online food sales grew 183% on March 1 and 25, vs. the same period last year. In addition to a poll that was made by CivicScience of US adults and their digital grocery shopping habits, the percentage of people who said they increased their online grocery shopping increased from 11% to 37% from March 1 to 22.

A Figure Shows the Change in US adults Digitial Grocery Shopping Activity due to the Coronavirus—March 2020

It is predictable that this consumer behavior will continue even if COVID-19 no longer exists because eCommerce habits tend to appear through phases of extreme activity, and when those habits already have energy, they become stickier.

Grocery eCommerce is now having a similar moment. Millions of first-time online grocery buyers are materializing, and millions of occasional buyers are now doing so on a weekly basis, vs. over many weeks or months.